Payment System in INDIA (Part 2)

Seamless & Non-Seamless PG Integration

In my last post i spoke about the PG categorization and i told about the success of PG also depends upon how merchant integrates with the PG . This post will tell you what is the integration type you should chose for your product/org.

Namely there are only 2 type of PG integration

- Seamless Integration (where payment option is selected at merchant’s site and PG directly takes you to BANK 3D Secure Page)

- Non-Seamless Integration (where payment option is selected at PG end and then PG takes you to BANK 3D Secure Page)

- third type i won’t suggest to my readers that includes iFrame Integrated solution (where the payment options look like taken at merchant’s site but actually its PG iFrame and then thus payment proceeds)

Mostly all of the PGs offers seamless and non-seamless integration kit for the integration with merchants but its your and only your choice to go for the PG integration model which suits your website/product.

SEAMLESS INTEGRATION

This is for Large Scale Product and organisations who have good finance team to jolt down the financials with the Banks for the DIRECT integrations and with PG Aggregators for the INDIRECT integrations and a good Dev team to integrate it neatly with your site/product.

If you have a Dev team for PG Integrations which can integrate multiple PGs for CREDIT/DEBIT and NETBANKING then you should go for SEAMLESS INTEGRATION where the payment options can be designed as per merchant’s choice and the look and feel can be retained as per the flavor of the website.

The seamless integration allows you to have less dependency on the PGs because you can change the PG on the run time to perform a payment transaction based on the success rate For eg. You have PAYU PG and CCAvenue PG as seamless integration for Credit/Debit Card if PAYU PG is down/fluctuating then you can always choose CCAvenue PG based on you configuration since the control is still at your (merchant’s end)

- Chose from The Payment Options at Merchant’s Site

2) Merchant can decide based on the success rates to select a seamless integrated PG for that payment transaction

3) PG will directly take you to the Card Bank’s 3D Secure page for actual payment after First Factor Authentication (minimal checks for the validity of the card and bank details)

Picture showing American Express 3D Secure page

Hope we understand the ifs and buts of the seamless integration now, the pros and cons which includes the flexibility at merchant’s end for choice but the hard work to integrate the PGs at their end too. Payment is no more simple.

NON-SEAMLESS INTEGRATION

Based on the flexibility and scalibility of the solution i suggest Small Scalle Business to use Non-Seamless Integration like PAYU or CCAVenue because in this case merchant website just do one integration and rest is taken care at PG’s end from payment collection to completion.

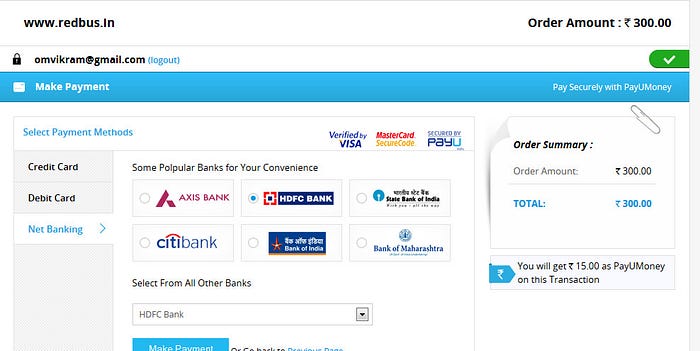

Picture showing Non-Seamless Integration where payment details is taken care at PG end. This means less risk and only one PG integration perfectly suitable for StartUps. But there are some odds too which means merchant wont have control over the payment options selectable for eg. if the PG offers a wallet to gain new customers your product/site wont have control over that. Other big problem in non-seamless integration is if the PG is down it impacts your transactions heavily since you were totally dependent on that.

Nowadays Startups also integrate 2 PGs with their site one for ACTIVE transactions another for BACKUP. So it might take some manual effort to switch the PG from integration level but you might be able to save numbers of transactions. Payment is no more complicated too.

With this POST i expect you guys to understand the basis of which we chose the payment gateway integration now. Next time when you interact with you fav e-commerce site please check whether the site is taking you to Wonderla or they are SMART enough to take you to your Bank directly :)